Understanding The Electronic Transaction Act

We certainly live in a digital era where electronic transactions form an essential part of everyday life such as online purchases, shopping and banking. But Transactions like these need some form of legal framework or governing which is carried out by the electronic transaction act. In this U.K. based blog, we will deep dive into what the electronic transaction act is, its objectives, and its importance in the legal sector of the U.K. This is how simplistic yet engaging we hope to make learning this essential U.K. based act.

What Is the Electronic Transaction Act in the UK?

The Electronic Transaction Act is simply a legal framework focused on guiding the regulation of electronic based transactions. Within the U.K context, this act serves as a pillar promoting the adoption of electronic communications in addition to the use of signatures within business and legal services. The act guarantees the legal recognition and enforcement of electronic transactions, meaning electronic transactions are just as effective as conventional transactions done on paper.

The persistent growth in the reliance on the use of digital communication and the use of formal barriers of hindrance, were the main reasons as to why the act was put in place in the first place. In so doing, the act advances the level of efficiency, security, and trust able to be invested in electronic transactions.

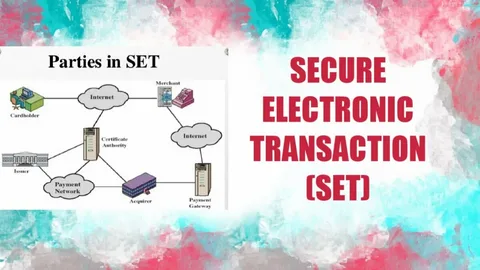

What Do You Understand by Electronic Transaction Act? ***The electronic transaction act is legislation that deals with the use of electronic means to carry out transactions. It incorporates a myriad of activities such as the creation, storage, and the transmission of records; storage and transmission of signatures. The Act’s primary focus is to validate the electronic processes enabling them to replace the paper-based system.*** For instance, an electronic signature on a contract is legally binding in the same manner as a signature written by hand. Likewise, invoices or receipts issued electronically possess as much legal authority as documents issued in physical form. ***There is the need to improve their wording. Improve their examples by taking away every quasi example and making it a valid example. To explain better, cite from the case of a sale of goods. Like how I am frequently moving around, do you really want to follow me around every time I am moving? Also, as we are all aware, the use of e-commerce and business transactions is expanding.*** What Are Electronic Transactions? ***Footnote* Transactions are digital in nature. The sale, purchase, or any type of agreement could be carried out through the internet and by no means physically withdrawn. Online transactions include:** ***Searching for products and services in e-commerce stores and buying them, doing banking services like fund transfers and payments, signing contracts electronically, sending and receiving documents through emailing, utilizing blockchain technology, be it for smart contracts or transferring funds.*** Electronic transactions have become the norm. They are quick, efficient, and more affordable than most conventional approaches, but they are built on the premise of trust and as such require a well defined legal apparatus in place for authentication, security, and to ascertain their validity.

What is the Aim of the Electronic Transactions Act 1999? The Electronic Transactions Act of 1999 was carried out with a number of key objectives in mind, including: Claiming Legal Recognition of Electronic Transactions The primary reason for the current Act is to ensure that electronic transactions are legally admissible. For instance, this means that electronic records and electronic signatures would be regarded as being equal to paper documents and an individual’s signature. One more Aims of E-Commerce The Act seeks to promote e-commerce by giving a clear legal basis for it. Businesses and consumers can deal with each other over the internet with the assurance that their contract is enforceable. Guaranteeing Safety and Authenticity The Act provides a framework for the safety and authenticity of electronic transactions. This encompasses electronic signatures, as well as the electronic records’ reliability and security. Removal of Obstruction to Digital Communication The Act seeks to relax obscured by physical documentation prerequisites via most legal systems such as before the Act and that hinders the ease and efficiency of digital communication. E-Commerce Expansion The Act is also supportive of UK businesses undertaking borderless electronic transactions and directs them towards internationally accepted standards.

Highlight of the Provisions of the Electronic Transaction Act

The Electronic Transaction Act is notable for its inclusivity towards objectives of its major provisions:

Legal Validity of Electronic Signatures:

The Act provides that an electronic signature shall be considered valid if it fulfills the requirements of a unique link to the signatory and the capability of signatory identification.

Recognition of Electronic Records:

Provided that electronic records are accessible and retain their integrity, they are considered equal in legal standing to paper documents.

Consent to Electronic Communication:

The Act ensures that all parties to a transaction must consent to the use of electronic communication, hence ensuring that no person is coerced to use digital means against their wishes.

Retention of Electronic Records:

Business institutions are obligated to maintain electronic records in a manner that ensures their accuracy and easy access for the purposes of future reference.

Exclusions and Limitations:

The revelation of the Act does not cover certain transactions which include wills, trusts, and powers of attorney. These exclusions are in place to cater to the special legal conditions of these documents.

Effects of the Electronic Transaction Act

Individual users and businesses alike have felt the ramifications of the Electronic Transaction Act from the time of its introduction. Here are some of the most important impacts:

Boosted Productivity

Electronic transactions save time and increase productivity as compared to conventional methods. Furthermore, electronic transactions reduce the administrative burden.

Reduced Costs

Electronic transactions save consumers and enterprises money by eliminating the need for paper, printing, and postage supplies.

Improved Protection

The Act encourages the use of secure electronic methods such as encryption and digital signatures to guard against fraud and unauthorized access.

Easier Access

Electronic transactions can be carried out at any time and place. This feature enables more people to partake in business and utilize various services.

Decreased Paper Usage

Electronic transactions aid in reducing the paper waste generated during business transactions, thus preserving the environment.

Limitations and Issues

In spite of the several benefits to the Electronic Transaction Act, there are some accompanying challenges that must be taken into account:

Digital Gap

Those who lack access to modern technology are unable to participate in electronic transactions. This inequality can have negative consequences and reduce the effectiveness of the Act.

Vulnerability Concerns

A downside of the Act is that electronic transactions are still susceptible to cyber threats such as hacking and identity theft.

Legal Complexity:

The legal complexity of the Act may be overwhelming for small businesses and individuals lacking legal knowledge and resources.

International Variations:

Legal differences among countries pose challenges for cross-border transactions, even with the existence of the international standards Act.

Conclusion

The Electronic Transaction Act facilitates the digital economy in the UK by providing legal support to e-commerce, thus increasing the effectiveness, security, and trust of online transactions. Businesses, consumers, and legal practitioners alike must take the time to grasp the features and consequences of the Act in this fast-paced digital environment.

There are bound to be further changes to the Electronic Transaction Act as new technologies emerge and new challenges are posed. At the moment, however, it remains the centerpiece of the United Kingdom’s legal system for e-commerce and ensures that digital transactions have the same legality as analog transactions.

Post Comment